About Company

Growing with our Clients

In order to honor our clients’ confidence in us and to consistently deliver optimum results, DAOL will strive to lead innovation in the financial markets, while adhering to a strict ethical code.

History

Originally founded in 1981 as Korea Technology Development Company, a government-funded investment vehicle specializing in technology-related investment opportunities, DAOL Financial Group(“DAOL”) has since grown into a comprehensive financial group offering a wide range of financial services, including securities, savings bank, asset management and private equity.

DAOL has been

steadily growing.

-

MAY. 1981

Established Korea Technology Development Company

-

NOV. 1996

Listed on KOSPI (DAOL)

-

SEP. 1999

Established DAOL Asset Management

-

JUL. 2008

Acquired DAOL Securities Thailand

-

AUG. 2008

- Received Securities License & Change Name to DAOL Investment & Securities

- Established DAOL Thailand

-

APR. 2012

Established DAOL Private Equity

(Spin-off from DAOL Investment & Securities PE Division)

-

NOV. 2018

Established DAOL REIT & DAOL Investment Management Thailand

-

JUL. 2019

Established DAOL New York

-

FEB. 2020

Established DAOL Lend Thailand

-

MAR. 2022

Change Name to DAOL

Businesses

Investment Banking

“Experts in structured finance”

DAOL's Investment Banking professional have long played leading role professionals in the structured finance market, with strong expertise in a wide range of alternative investment products, including real estate / SOC, aircraft and ship financing and renewable energy. DAOL employs a variety of advanced financial techniques in raising capital for large-scale projects and long-term investment opportunities for institutional clients.

DAOL provides truly presents customized solutions that address the diversified financial needs of our corporate clients.

Wholesale Brokerage

“Speedy and accurate response to client’s requests”

Institutional investors need a trusted partner who can provide speedy and accurate solutions in order to maximize their returns. DAOL offers a wide-ranging financial product lineup for institutional investors that goes beyond the traditional offerings such as stock, bonds and derivatives and have been able to maintain its status as one of the preferred partners for institutional investors.

Research Center

“Conducting research to help clients”

Today’s financial markets require an investment strategy that can adapt to the fast-changing market conditions. DAOL Research Center provides up-to-date and insightful market information, based on the accumulated knowledge base and expertise of industry leading analysts.

FICC

“DAOL’s solution for both return and risk management”

In this rapidly changing economy, traditional assets such as stocks and bonds are constantly challenged in terms of volatility and yield. To overcome the limitations of the traditional assets, DAOL offers a variety of OTC derivative products with various risk-return profiles for investors with a focus on derivative-linked securities (ELS, DLS).

Retail Financial services

“DAOL for smarter individual investors”

Both individual and corporate investors require a stable trading platform, a variety of financial instruments and in-depth investment consulting services. DAOL has been effectively dealing with such customer needs through various retail services, including online account opening and customized Wrap Account services

Wrap Account : managed account with annual based fee

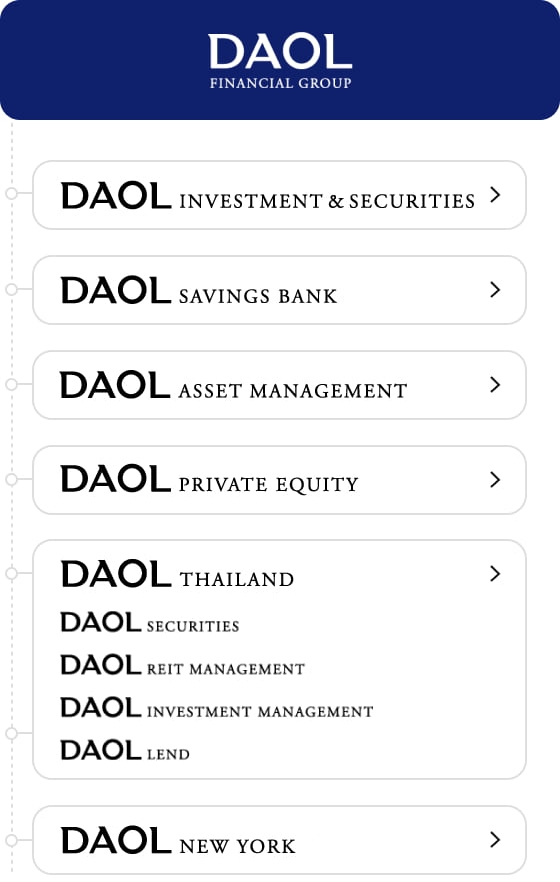

Subsidiaries

Subsidiaries of

DAOL Securities